GDP data out of the US today was better than expected with QoQ annualised return hitting 5.7%. Personal consumption was also slightly better than expected. The S&P reacted as would be expected, ralling from today's low of 1,070 (March Fut) back up to 1,090. I took the opportunity to close out the rest if the Lloyds position (+253 points) and the Exxon short (+101 points) and also added to my short S&P position at 1,088.

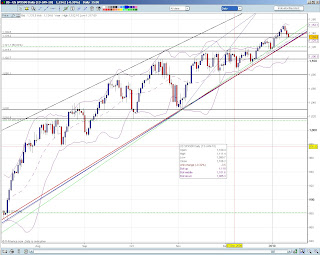

I am still bearish - the index is making lower lows while failing to breach the upper level of the range.

Key levels to keep an eye on (March Fut):

- Resistance: 1,090 ; 1,103 - a break above 1,103 would lead to re-evaluating shorts

- Support: 1,080 ; 1,071 (today's low) ; 1,066

Google Search

Custom Search

Friday 29 January 2010

Thursday 28 January 2010

Profit taking...

The S&P pretty much did exactly what I was expecting today - we saw a retrace back up to the resistance at 1,103 on the March Future (1,107 on the cash index) and a subsequent fall. I used the retrace to add to my short S&P position. I am expecting it to return to the recent lows around 1080 (March fut). The employment news out of the US today was not great which adds to my bearish bias. US GDP data is out tomorrow and some big firms are scheduled to release results over the next week (including Microsoft and Amazon) which should give an indication to the price action we can expect in the short term.

I also took closed the IBM trade at a nice profit (+152 points) and closed half of the Lloyds position (+265 points) to lock in some realised profit.

I also took closed the IBM trade at a nice profit (+152 points) and closed half of the Lloyds position (+265 points) to lock in some realised profit.

Wednesday 27 January 2010

A little note on the S&P...

Just had a close look at the S&P cash index - following what I was saying below about the fact that it may be trading in a range, today's double bounce off the support @ 1,085 may be a sigificant signal to suggest that we may see a retrace of the fall back up to the 1,100 level. Something that is worth keeping an eye on.

Downside favoured...add to shorts!

Quick update - the S&P has continued to fall on the uncertaintly surrounding banking reform. The index has fallen 4.69% since breaking it's diagonal support.

This obviously has implications on single names. I have used a tool I have built to identify stock where they may be the technicals to take advantage of the drop. My tool threw out Anglo American, Prudential, Exxon Mobil and IBM as good technical shorts should the fall continue. This is in addition to the Lloyds and Bank of America shorts I added previously. It makes sense that financial and oil related stocks are the first to be hit.

Short term it looks like the S&P is trading in a range between 1,100 and 1,081 (March 2010 future). For this reason, I cut half my short S&P. I also lost conviction on the Ford position and closed it at a small loss. I will look to a break above 1,100 reassess my shorts. In the meantime, I will be looking for a break of 1,081 to add to my shorts while keeping a close eye on the the single name charts for support areas to close my positions.

I have changed the structure of the portfolio table to make it easier to follow. I have added a hypothetical account balance of £10,000 and you can track the performance by looking at the current value of the portfolio on the top left of the caption. It is also easier to assess the margin requirements of putting on similar positions with most online brokers.

This obviously has implications on single names. I have used a tool I have built to identify stock where they may be the technicals to take advantage of the drop. My tool threw out Anglo American, Prudential, Exxon Mobil and IBM as good technical shorts should the fall continue. This is in addition to the Lloyds and Bank of America shorts I added previously. It makes sense that financial and oil related stocks are the first to be hit.

Short term it looks like the S&P is trading in a range between 1,100 and 1,081 (March 2010 future). For this reason, I cut half my short S&P. I also lost conviction on the Ford position and closed it at a small loss. I will look to a break above 1,100 reassess my shorts. In the meantime, I will be looking for a break of 1,081 to add to my shorts while keeping a close eye on the the single name charts for support areas to close my positions.

I have changed the structure of the portfolio table to make it easier to follow. I have added a hypothetical account balance of £10,000 and you can track the performance by looking at the current value of the portfolio on the top left of the caption. It is also easier to assess the margin requirements of putting on similar positions with most online brokers.

Monday 25 January 2010

S&P broke down - start of a new bear?

Following Mr.Obama's comments on banking reform on Thursday, the S&P conculsively broke it's long term support on the downside. This prompted me to stop and reverse my long S&P position. As you can see below, the size of my short is double that of the long position I had previously - this is because my conviction for trading the break of the support was very strong.

The apparent reversal in the market also caused some of my longs to get stopped out - namely Cameco Corp and the Powershares Water Fund. From this I decided to reduce the risk of the portfolio and close the EM ETF and the iShares Energy Fund. The reason is that the portfolio feels overweighted on the long side considering this may be the start of a wave down.

I have opened short positions in Lloyds, Bank of America and Ford to hopefully capture some of the move down. You can see the details below - I will follow up with graphs in due course.

The apparent reversal in the market also caused some of my longs to get stopped out - namely Cameco Corp and the Powershares Water Fund. From this I decided to reduce the risk of the portfolio and close the EM ETF and the iShares Energy Fund. The reason is that the portfolio feels overweighted on the long side considering this may be the start of a wave down.

I have opened short positions in Lloyds, Bank of America and Ford to hopefully capture some of the move down. You can see the details below - I will follow up with graphs in due course.

Monday 18 January 2010

S&P level tested and held....so far!

The diagonal support on the S&P (March 2010 future) looks to have held for the time being - although it is Martin Luther King day in the US and the equity markets aren't open (futures are trading). I am expecting a continuation of the bounce tomorrow with mining leading the way - which should be some much needed good news for Cameco.

American banks will be in the headlines this week, with earnings reports from Citigroup (Tues), Bank of America, Morgan Stanley, Wells Fargo (Wed), Goldman Sachs, American Express and ICICI (Thurs). General Electric are reporting on Friday and IBM's results on Tuesday should give an indication about US business spending. Trading updates from the US airlines Continental and Southwest will come in on Thursday.

American banks will be in the headlines this week, with earnings reports from Citigroup (Tues), Bank of America, Morgan Stanley, Wells Fargo (Wed), Goldman Sachs, American Express and ICICI (Thurs). General Electric are reporting on Friday and IBM's results on Tuesday should give an indication about US business spending. Trading updates from the US airlines Continental and Southwest will come in on Thursday.

Friday 15 January 2010

S&P Update - Back on support and looking weak

Quick note - the S&P is right on it's support, despite the good financial results out today. We may see a continuation of the correction at the beginning of next week. Keep a close eye on the cash breaking 1,130 and the March Future breaking 1,127 - if it does I will look at stopping and reversing the long position and also re-evaluate the Emerging Markets ETF and the iShares S&P GBL Nuclear Energy positions.

Have a good weekend all!

Have a good weekend all!

Cameco Corp looking weak

Cameco Corp is dropping towards it's stop at 30 - I have decided to move my stop 29, just below the medium term support. The reason for this is because I view the position as a long term trade. What I don't want to happen is to get stopped out when the long term support is broken then seeing the medium term support hold and the price bounces back up past the long term support.

Also, see the latest performance of my portfolio below. The average was as high as 4.5% during this week, but today's drop in the equity markets has wiped off some of those gains. The retail and jobless claims data out of the US was pretty bad. The S&P is back testing it's long term support - again I am expecting the level to hold. However the end to this week and the beginning of next should give a clearer indication to the short term direction of the market. Keep an open mind!!

Thursday 14 January 2010

S&P Support Holds - portfolio update

The S&P bounced off it's support in style yesterday which is good news for all the bulls out there. From a technical perspective, this weeks candle formation is all important - at the moment it is showing a 'doji' which conveys a sense of indecision between buyers and sellers. It could be that the the buying pressure is starting to weaken. Obviously, we have to wait until the candle is fully formed to infer anything, but it is worth noting that the candle may signal the start of a reversal.

The latest performance of my portfolio is below - I have included hypothetical 'bets' for those looking at the leveraged spreadbetting option. As you can see, using leverage significantly increases the percentage returns as determined by the margin required to put the positions on.

Note - the £100/pt shown for equities is the same as £1/pt where the tick size is x100 (as offered by most spread betting brokers). For example, Shaw Group trading @ 3240 (32.40 x 100), long £1/pt.

The latest performance of my portfolio is below - I have included hypothetical 'bets' for those looking at the leveraged spreadbetting option. As you can see, using leverage significantly increases the percentage returns as determined by the margin required to put the positions on.

Note - the £100/pt shown for equities is the same as £1/pt where the tick size is x100 (as offered by most spread betting brokers). For example, Shaw Group trading @ 3240 (32.40 x 100), long £1/pt.

Wednesday 13 January 2010

S&P - Big break??

For those who are interested, the S&P is hovering around it's long term diagonal support on the weekly and daily chart (formed since the March 2009 low). A break of this line may be a key signal so I am keeping a very close eye. As you can see, I am currently long the S&P in my virtual portfolio. Tomorrow's retail sales data and inflation data on Thursday could be key. See below for graphs...

A New Beginning....

As you may have noticed, it's coming up to a year since I last updated my blog! March 2009 was a very busy time for me career wise, so I ended up sacrificing my blogging duties so I could have a life. Now thing's have calmed down a bit and I have had some good news!

I am going to be writing monthly articles for GX Magazine on my views on the economy and investment ideas. The articles are going to be supplemented by entries on my blog - readers can follow my latest thoughts, check my graphs and follow the performance of my virtual portfolio.

My first article is appearing in February's edition so I cannot go into too much information on here before it is published.

I thought I'd share my virtual portfolio in the meantime - I have selected the following positions based on my views on how I believe the economy is going to perform in the year ahead and beyond. Short(ish) term I am bullish the equity markets (US and emerging markets), medium to long term I am bullish the nuclear sector and gold. I have also gone for a defensive play with a water fund. Should my views change, I will update on here. You can see the performance below - I will be monitoring the positions daily and once the article is published, I will upload the charts. Click on the below table to open in a new window.

The opening prices are from the 4th January when I started writing the article. They are securities that I have been watching for months and ones I believe are worth looking at for good growth potential.

The average performance can be used as an indicator for the performance of a portfolio made up of an equally value weighted portfolio of the securities on the table.

I am going to be writing monthly articles for GX Magazine on my views on the economy and investment ideas. The articles are going to be supplemented by entries on my blog - readers can follow my latest thoughts, check my graphs and follow the performance of my virtual portfolio.

My first article is appearing in February's edition so I cannot go into too much information on here before it is published.

I thought I'd share my virtual portfolio in the meantime - I have selected the following positions based on my views on how I believe the economy is going to perform in the year ahead and beyond. Short(ish) term I am bullish the equity markets (US and emerging markets), medium to long term I am bullish the nuclear sector and gold. I have also gone for a defensive play with a water fund. Should my views change, I will update on here. You can see the performance below - I will be monitoring the positions daily and once the article is published, I will upload the charts. Click on the below table to open in a new window.

The average performance can be used as an indicator for the performance of a portfolio made up of an equally value weighted portfolio of the securities on the table.

Please feel free to contact me if you have any questions or comments!

Subscribe to:

Posts (Atom)