I closed my short ESM0 positions at a decent profit of £570, but if I had closed at the bottom I could have realised £870. Luckily I employed a trailing stop. The reason I held the trade for so long following the bounce was that I had intended to keep the position open for the long run if the ‘W’ shape were to be fulfilled. This was not the case, and even though I could have made more money by closing the position when it was in profit, I stuck to my initial conviction. Put it this way, if I had closed near to the bottom, but the market fell even further confirming my initial view, I would be kicking myself even harder than I am now! But that’s the name of the game; you have to take risks to make the big bucks!

I have been watching news of the election in the UK unfold and the sentiment seems to be that we may be heading for a hung parliament (where no one party has an overall majority). This would be terrible news for the pound. I have taken a couple of short sterling trades based on technicals. I will post the graphs another time.

I am in favour of a change in government and that means that I am supporting the Tories, but that is mainly because they are the best of a bad bunch! The fact that they plan to tackle the UK's deficit as soon as possible is a positive step and I think that a continuation of the Labour government would be bad news for the British economy and our credit rating.

I have also taken a couple of short term short positions on the S&P (ESMO - June contract) and the FTSE (Z HO) again based of the technicals - you can see the graphs below.

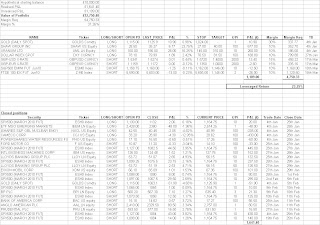

The portfolio is perfoming steadily with a 20.8% return over the initial investment.

killing it

ReplyDeleteGreat stuff, when can we expect the next instalment. Been waiting over a year for it.

ReplyDelete